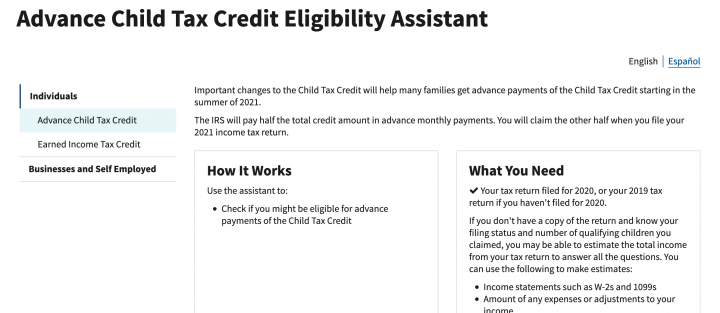

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. For parents and guardians of dependent children the Internal Revenue Service IRS provides a tax credit that can help reduce your tax liability for the 2020 2021 tax season.

New parents can qualify for child tax credit payments.

Irs child tax credit 2021 amount. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers. In 2021 the credit will be 3000. The payment for children.

The expansion includes those unemployed those who otherwise do not owe federal income tax and families with no income are also eligible to receive the credit. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return during the 2022 tax filing season. Child Tax Credit amounts will be different for each family Your amount changes based on the age of your children.

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Because these credits are paid in advance every dollar you receive will reduce the amount of Child Tax Credit you will claim on your 2021 tax return.

In 2021 the maximum enhanced child tax credit is 3600 for children. For 2021 the credit amount is. 112500 if filing as head of household.

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. 31 2021 will receive the full 3600 tax credit. This tax credit amount has increased from 2000 for all children to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17.

Thats up to 7200 for twins This is on top of payments for any other qualified child dependents you claim. This means that by accepting advance child tax credit payments the amount of your refund may be reduced or the amount of tax you owe may increase. 3000 for qualifying children between age 6 to 17 years old 3600 for qualifying children age 5 and under.

Thats up to 7200 for twins. Previously the credit had excluded children who had turned 17 and was limited to 2000 per child. The only variation will be in.

These changes apply to tax year 2021 only. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. That changes to 3000 total for each child ages six through 17.

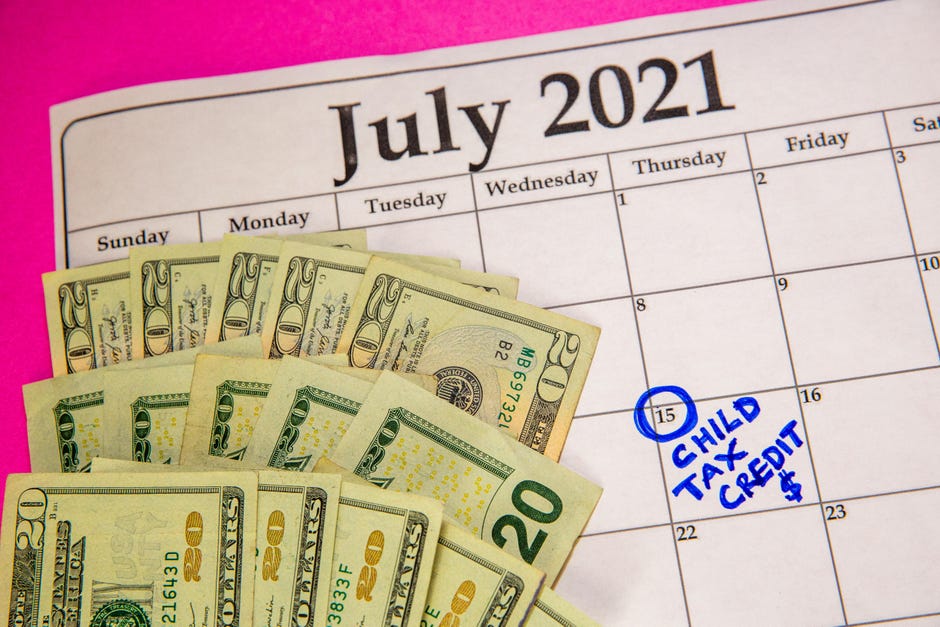

All children who meet all other qualifications born on or before Dec. How Much Is The New Child Tax Credit. Well issue the first advance payment on July 15 2021.

Aside from having children who are 17 or younger as of December 31 2021. Ages five and younger is up to 3600 in total up to 300 in advance monthly. For a full schedule of payments see If Im eligible to receive advance Child Tax Credit.

The expanded credit was established in the American Rescue Plan signed into law in March. You may avoid owing tax to the IRS if you unenroll and claim the entire credit when you file your 2021 tax. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States.

The changes increased the child tax credit from 2000 to 3000 for children over 6 and to 3600 for children under 6. Currently the new tax credit. 150000 if married and filing a joint return or if filing as a qualifying widow or widower.

For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. You will claim the other half when you file your 2021 income tax return. If the IRS has processed your 2020 tax return or 2019 tax return these monthly payments will be made starting in July and through.

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. And parents of twins can get up to 7200. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

For a 10-year-old child the credit was worth 2000 in 2020 which lowered a familys tax bill by that amount when they filed their return Wacek explained. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The eligible amount for each qualifying child between 6-18 at the end of 2021 is 3000 and 3600 for each child under six.

3 Quick Ways To See If You Re Eligible For The July 15 Child Tax Credit Payment Cnet

Child Tax Credit 2021 Who Will Qualify For Up To 1 800 Per Child This Year Fox Business

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Tax Day 2021 Child Tax Credit Other Changes

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Dates Ages Qualifications Eligibility And Everything You Need To Know Marca

Child Tax Credits Irs Unveils Online Tool As It Prepares To Send Out July 15 Payments

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Child Tax Credit Opt Out When Is The Deadline Kxan Austin

2021 Child Tax Credit Who Qualifies For Monthly Payments

Hooray This Irs Tool Will Tell You If You Qualify For Child Tax Credit Payments Cnet

Higher 2021 Child Tax Credits Monthly Payments From Irs Beginning July 1st Youtube

How Child Tax Credit Portals Help Parents Get Extra Money This Year And Next Cnet

American Rescue Plan Act 2021 Child Tax Credit Stimulus When You Can Get It How Much And Who Qualifies For It Marca

July 15 Child Tax Credit Check For 250 Or 300 Calculate Your Total In Less Than A Minute Cnet

2021 Child Tax Credit Does Each Kid Qualify For The Full 3 600 We Ll Explain Cnet

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)